Mortgage calculator with extra payments dave ramsey

Make minimum payments on all your debts except the smallest. The earlier into the loan you do this the more of an impact it will have.

Pay Off Mortgage Calculator Sale 59 Off Www Wtashows Com

Save up a down payment of at least 20 so you wont have to pay private mortgage insurance PMI.

. 2 MIP can tack on an extra 100 a month per 100000 borrowed. Whatever the frequency your future self will thank you. So if you make your monthly mortgage payments on time then youre probably already paying your property taxes.

Heading into 2022 experts forecasted 30-year mortgage rates to increase to 36. Repeat this method as you plow your way through debtThe more you pay off the more your freed-up. Use Daves mortgage payoff calculator to see how fast you can pay off.

Now crunch the numbers with our free mortgage calculator to figure out a monthly payment your budget can handle. Check out The Ascents best personal loans for 2022 For many people cars are an. In a typical 30-year mortgage about half the total interest you pay will accumulate in the first 10 years of your loan.

Make minimum payments on all debts except the smallestthrowing as much money as you can at that one. Budget for closing costs. Rip-offs like the 30-year mortgage FHA VA USDA and adjustable-rate mortgages will charge you tens of thousands of dollars extra in interest and fees and keep you in debt for decades.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. You get the drill. Make Extra House Payments.

In the mortgage calculator you can type in your purchase price interest rate down payment taxes and more to get a monthly payment breakdown andor a full payment schedule. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Make more frequent payments.

What I really like about Dave Ramseys 7 baby steps is how any individual can use them as a blueprint. 7 Well those experts were way. The only way to get rid of MIP is if you have more than a 10 down paymentbut even then youll still have to pay it for 11 years.

For a 200000 house a 20 down payment is 40000 200000 x 20. Financial expert Dave Ramsey says you shouldnt carry that debt -- even if youre not paying interest on it. Dave Ramseys baby steps can be worthwhile financial planning tactics that can help you live a debt-free life and position you to build wealth more quickly.

For first-time home buyers a smaller down payment like 510 is okay too. Your mortgage payments including PMI property taxes insurance and HOA fees should all be below that 25 of your income calculated in step one. See which type of mortgage is right for you and how much house you can afford.

To reach the best long-run outcomes for your money there are two guidelines to keep in mind as you head into the mortgage process. Once that debt is gone take its payment and apply it to the next smallest debt while continuing to make minimum payments on the rest. Your budget is too tight you cant afford your day-to-day bills and.

As a co-host of The Ramsey Show Americas second-largest talk radio show Rachel reaches 18 million weekly listeners with her personal finance adviceShe has appeared. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Lets say Jim and Pam decide to buy a home and their mortgage lender estimates theyll owe 1600 in property taxes each year.

PMI is a fee you pay that protects your lender not you if you stop making mortgage payments. If a reverse mortgage lender tells you You wont lose your home theyre not being straight with you. Repeat until each debt is paid in full.

Just including your rent or mortgage payment isnt enough when budgeting for your housing costs. Make an Extra Mortgage Payment Every Year. At Ramsey Solutions we also teach people they cant afford to buy a house until they.

Think about the reasons you were considering getting a reverse mortgage in the first place. Heres how you pay property taxes as part of your mortgage payment. That means if youve borrowed 200000 thats an extra 200 on top of your regular mortgage payment each month.

Use our free mortgage calculator to easily estimate your monthly payment. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. Heres why he thinks this is a bad idea for most borrowers.

For decades Dave Ramsey has told radio listeners to follow the 25 rule when buying a houseremember that means never buying a house with a monthly payment thats more than 25 of your monthly take-home pay on a 15-year fixed-rate conventional mortgage. And then work with an expert agent. And lets not forget how interest rates will affect the overall cost of your home.

Dave Ramsey Mortgage Payoff Calculator. PMI is an extra cost added to your monthly payment that. You absolutely can lose your home if you have a reverse mortgage.

To be safe budget on the higher sideand if you dont end up needing it throw the extra at your debt if you have any or your savings. Ideally youd put down at least 20 of the home price to avoid private mortgage insurance PMI. Frigid winter temps.

Dave Ramsey Mortgage Calculator. Pay as much as possible on your smallest debt. Rachel Cruze is a 1 New York Times bestselling author financial expert and host of The Rachel Cruze ShowRachel writes and speaks on personal finances budgeting investing and money trends.

If your largest debt has the largest interest rate its going. Last year interest rates were at an all-time lowaveraging 23 for a 15-year fixed-rate mortgage and 3 for a 30-year fixed-rate mortgage. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. But they arent foolproof. Add a few bucks.

Dave Ramsey Rachel Cruze. Now before you start arguing about the interest rates hear us out. Finance expert Dave Ramsey warned against taking out an adjustable-rate loan.

If youre using the wrong credit or debit card it could be costing you serious money. Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance.

Put at least 10 down 20 is even better because it lets you avoid Private Mortgage Insurance and make sure your monthly payments are 25 or less of your take-home pay. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. You Could Lose Your Home.

If for example you have been making payments for seven years on a 30-year mortgage and refinance into a new 30-year loan remember you will be making seven extra years of loan payments. List your debts from smallest to largest regardless of interest rate. Highest cash back card weve seen now has 0 intro APR until nearly 2024.

Put on some fuzzy socks.

Pay Off Mortgage Calculator Sale 59 Off Www Wtashows Com

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Budgeting

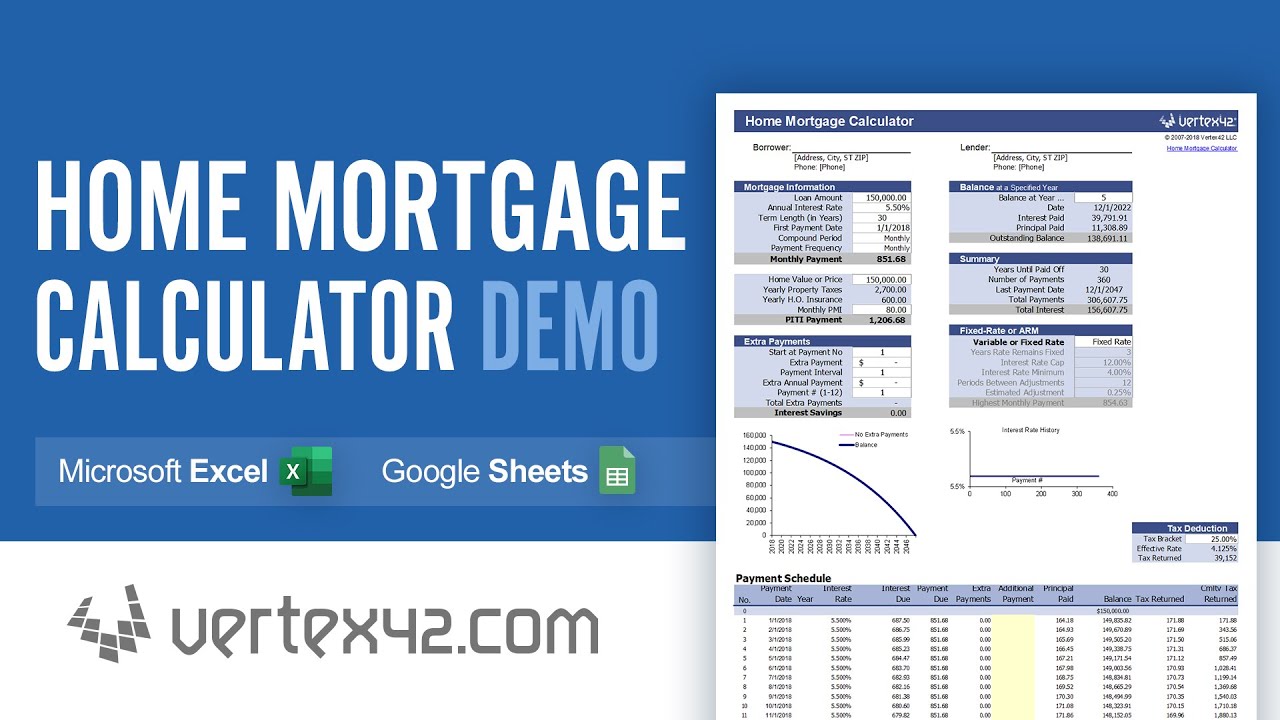

Home Mortgage Calculator Demo Youtube

Pay Off Mortgage Calculator Clearance 55 Off Www Wtashows Com

Florida Mortgage Calculator Ramseysolutions Com

Pay Off Mortgage Calculator Factory Sale 54 Off Www Wtashows Com

Mortgage Calculator Calculate You Montly Payments On Your Mortgage How Much Interest Will You P Mortgage Payment Calculator Mortgage Tips Mortgage Calculator

Top 20 Mortgage Calculator Tools Startup Stash

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Best 10 Mortgage Calculator Apps Last Updated September 9 2022

Is Dave Ramsey Right About How Much House You Can Afford

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Mortgage Calculator With Early Payoff Hot Sale 54 Off Www Wtashows Com

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Ireland

Advanced Mortgage Payoff Calculator R Daveramsey

Loan Amortization Schedule For Excel Amortization Schedule Loan Repayment Schedule Excel Templates